PropNex Picks

|December 27,2024Green Flags to Spot When Choosing a New Launch

Share this article:

Remember the "blockbuster" fortnight we had recently when six new projects were launched over two weekends? I'm sure if you were a buyer in the market looking out for a new launch to purchase, you'll probably be scratching your head hard with all the choices that's available. Apart from the six that were launched over the two weekends, there are still a slew of new launches that are available to choose from in the inventory of projects that have yet to sell out.

Do you base it on the extravagance of the showflat? Or is how excited the cinematic project video is? I am sure you are smart enough not to be swayed by such things. That is why you are reading this article. Let's take a look at factors that make a new launch a green flag.

Looking at the track record of a developer is relatively important as you want to know how they fare in their previous projects. Here are some pointers you might want to know:

Established Reputation: Choose a developer with a proven track record of delivering quality projects on time. Research their past projects and customer satisfaction to assess their reputation.

Track Record: A developer's history of completed projects is crucial. Look for evidence of quality construction and positive customer feedback. Awards can also indicate a high level of industry recognition.

Innovation: Trust developers who embrace innovation by incorporating sustainable building practices, smart home technology, and future-proof designs that meet modern needs and environmental standards.

Transparency: Choose developers who are open and honest about project progress, potential delays, pricing, and customer concerns. Transparent communication builds trust and ensures customer satisfaction.

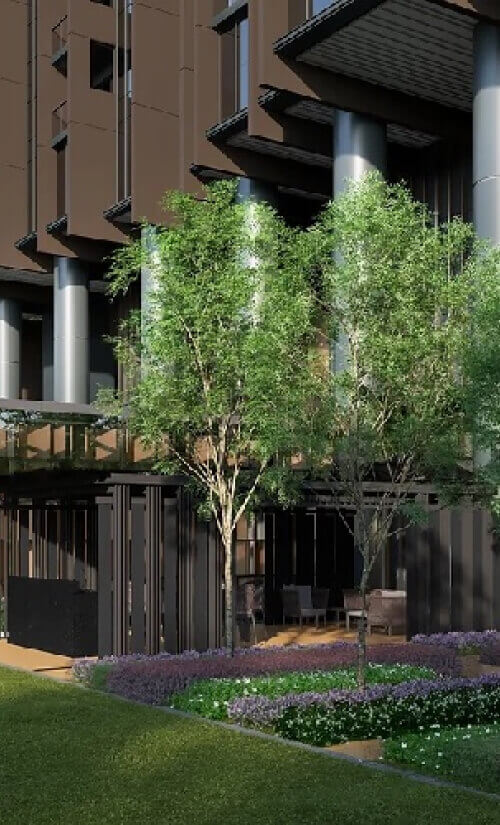

I think for those who are unfamiliar with the first mover advantage, it is essentially moving into a neighbourhood before the value of the area starts to surge. A great example to look at would be the West Coast estate.

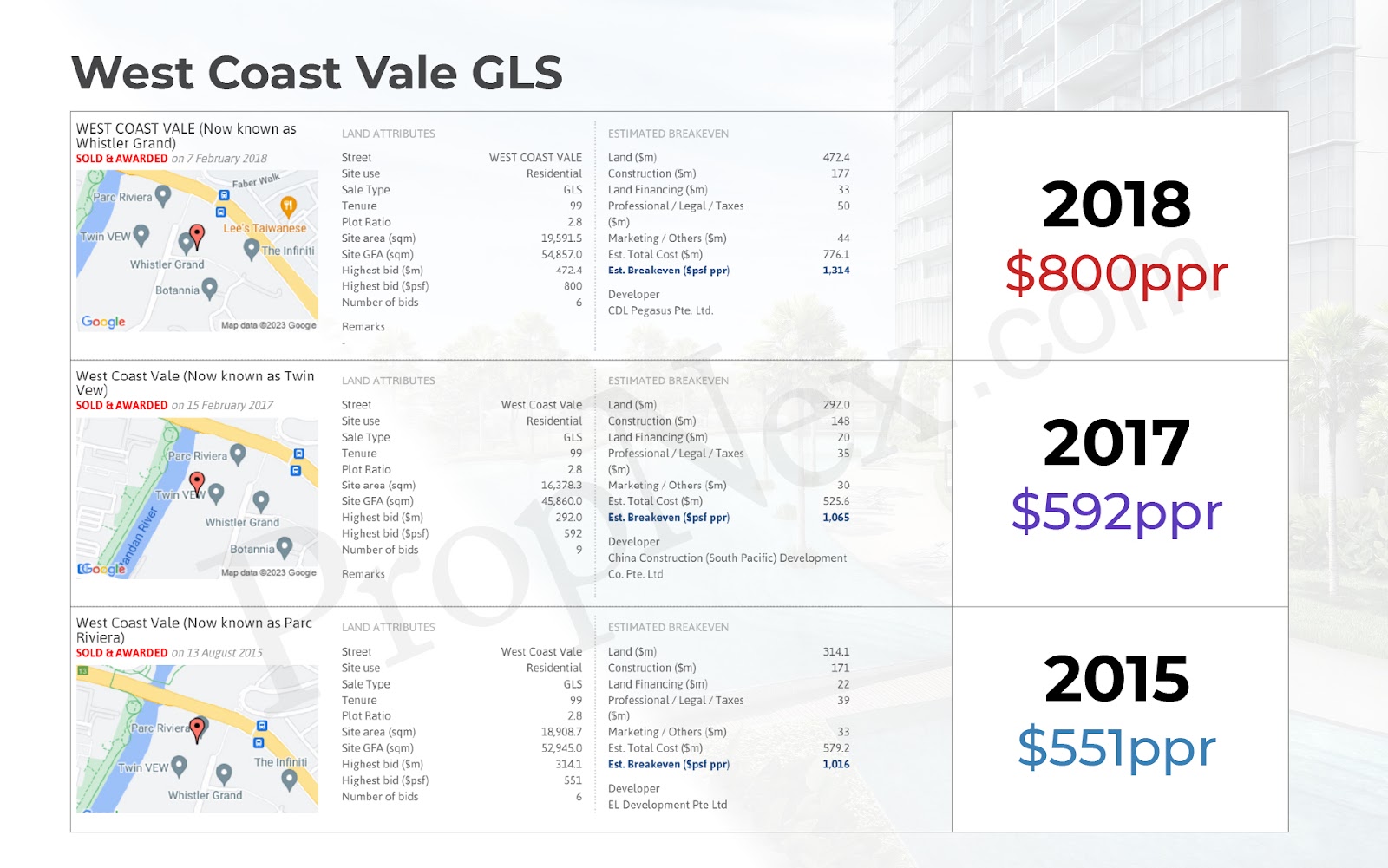

With the Government Land Sale getting more and more expensive over the years, prices of the development have to go up as well. Take a look at Parc Riviera which was launched the first out of these three land parcels.

Out of the 285 transactions, all of which saw profits, with the highest one being at $815,000. Can you imagine netting more than $800,000 in profit over a seven year period, is that insane or insane?

As the famous Singaporean saying goes "every school is a good school". Yes I definitely agree, Singapore is known to have one of the best education systems in the world. BUT, but is the key word here, some schools in Singapore are deemed as a step above the rest. The demand for properties within the vicinity tends to be higher, which will drive up the prices for these properties.

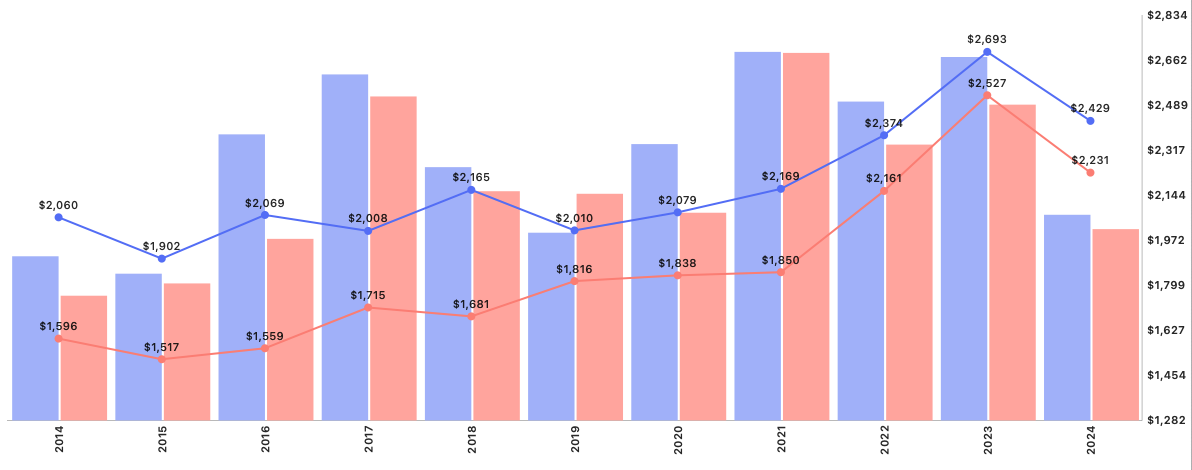

The chart above represents prices of private homes within a 1-kilometre radius (blue line) around Anglo-Chinese School (Junior) versus the rest of the private homes in District 11 (red line) over the past five years. You can see clearly that the prices of homes within 1 kilometre of ACS Junior commands better prices. The average psf between homes near ACS Junior and the rest of District 11 are $2,429 and $2,231 respectively as at the start of December 2024.

Another key thing to look at is the transformation and rejuvenation plans in the area you are buying into, that could serve as a great indication on the future prices and potential of your property. Looking at Urban Redevelopment Authority's (URA) Master Plan is a good way to find out what are some of such plans. The URA Master Plan is reviewed about every five years and it guides Singapore in terms of development in the medium term over the next 10 to 15 years.

Good examples of transformations that are bolstering prices in an area are the Jurong Lake District, Punggol Digital District, or the Paya Lebar Sub-Regional Centre. Usually such transformation brings about job creation and that indubitably creates demand for housing.

The simple and most layman way to put this is "buying low". It makes sense to most people because buying low will allow you potentially reap more profit. But what's more important than buying low is to understand the fundamentals of whether you are buying in at a safe price. How do you determine a safe price?

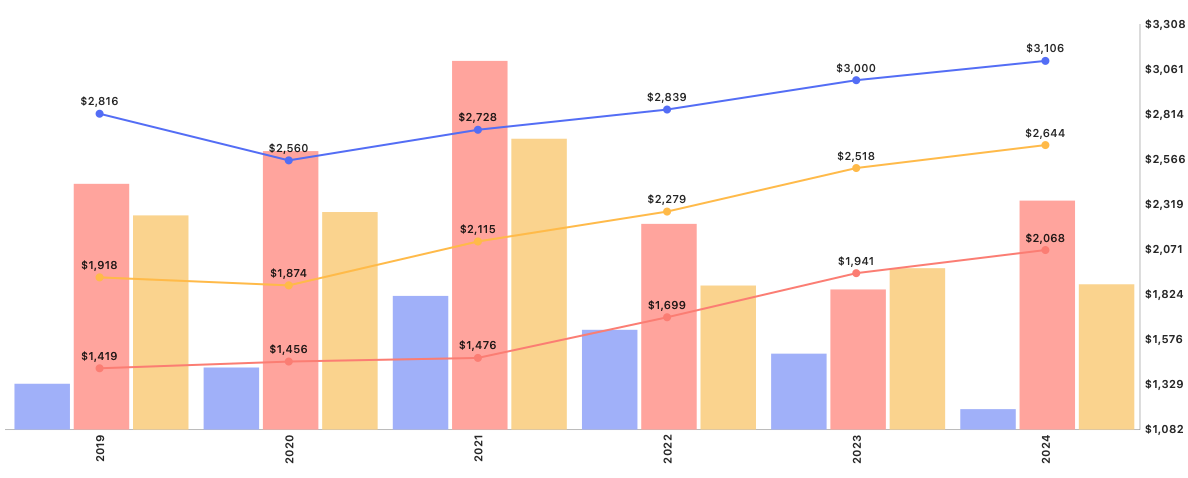

(CCR(blue line), RCR(yellow line), OCR(red line) new launch average prices)

A safe and simple way to look at it is to compare the average prices of new launches in the new launch you are considering at a macro level. To go into even more micro level is to compare it at a district level and even surrounding properties. But there's more intricate parts to determining what's considered "low" that perhaps only a professional with real-time data could provide answers to.

Just as selecting a property with a solid entry price is crucial, having a clear exit strategy is equally important and should never be overlooked. Many investors only start thinking about their exit plans after they've already purchased the property, but in reality, it should be a key consideration from the outset. Your exit strategy can vary depending on your financial goals and current life stage. Whether you're aiming for short-term gains, medium-term growth, or a long-term hold, the property you choose should align with your broader strategy. When evaluating a new property launch, ensure it supports your exit plan, helping you achieve the goals you've set for the future.

Remember this golden rule, if you do not know what to do with the money after selling, don't sell. Make good use of the money to continue working hard for you, that's what a savvy investor would do. Hence, an exit plan is very important.

To sum up, there are several key factors that help determine whether a particular development raises more green or red flags, providing valuable insight into whether it's a worthwhile investment. It can be quite dangerous if you leave it to your own understanding trying to decipher what's the best move ahead for you.

While understanding these surface-level indicators is a good start, there's much more beneath the surface, and plenty more to learn. In addition to familiarising yourself with these fundamentals, you can also consult a real estate professional for guidance-or, if you're like me, consider attending the Property Wealth System Masterclass. It offers a comprehensive understanding of the property market, equipping you with the knowledge and strategies needed to make an informed decision about your ideal home or investment property. Be like me, attend the Property Wealth System and you'll see for yourself!

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position.